EXECUTIVE SUMMARY

Developed and compared multiple ensemble machine learning models to predict credit card attrition for Pinnacle Bank, delivering a high-recall solution to identify at-risk customers and support targeted retention campaigns.

Goal:

Build a predictive model that flags customers likely to churn so retention teams can intervene and reduce revenue loss.

Approach:

Conducted extensive EDA on 10,000+ customer records and addressed class imbalance with resampling techniques. Trained and evaluated several powerful classifiers, including Random Forest, Gradient Boosting, and XGBoost. The evaluation prioritized a balance of precision and recall to effectively identify true churners.

Outcome:

The XGBoost Classifier provided the best performance, achieving 85% recall and 92% precision on the test set. This model outperformed the others and provides an actionable framework for proactive retention strategies.

THE CHALLENGE

Customer attrition is a persistent challenge for credit card issuers. Even small increases in churn rates have significant revenue impacts given the high customer acquisition costs. Pinnacle Bank required a model that could reliably predict which customers were likely to close their accounts so the bank could focus retention resources efficiently.

MY APPROACH

1. Data Preparation & Feature Engineering:

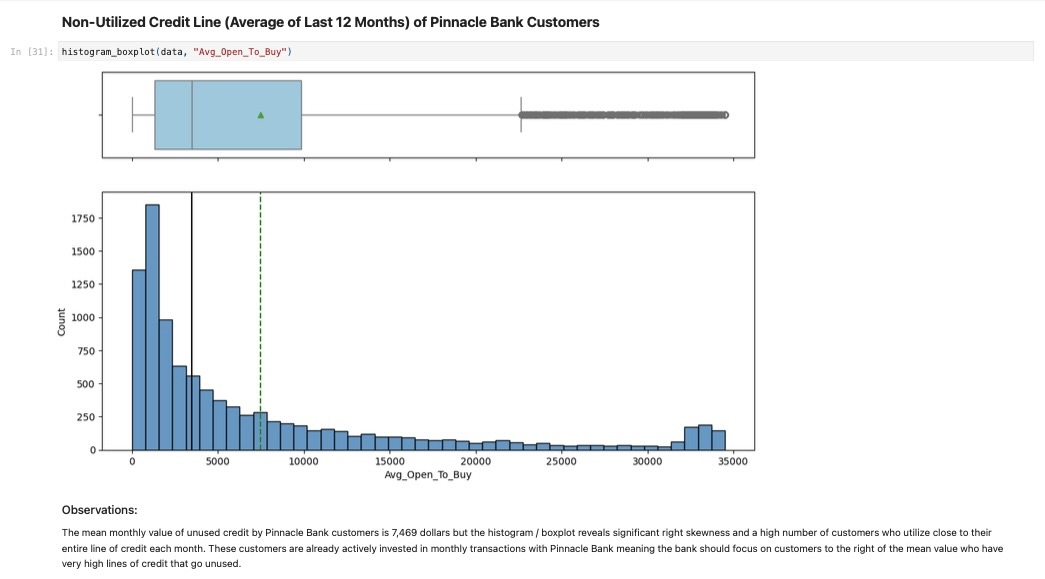

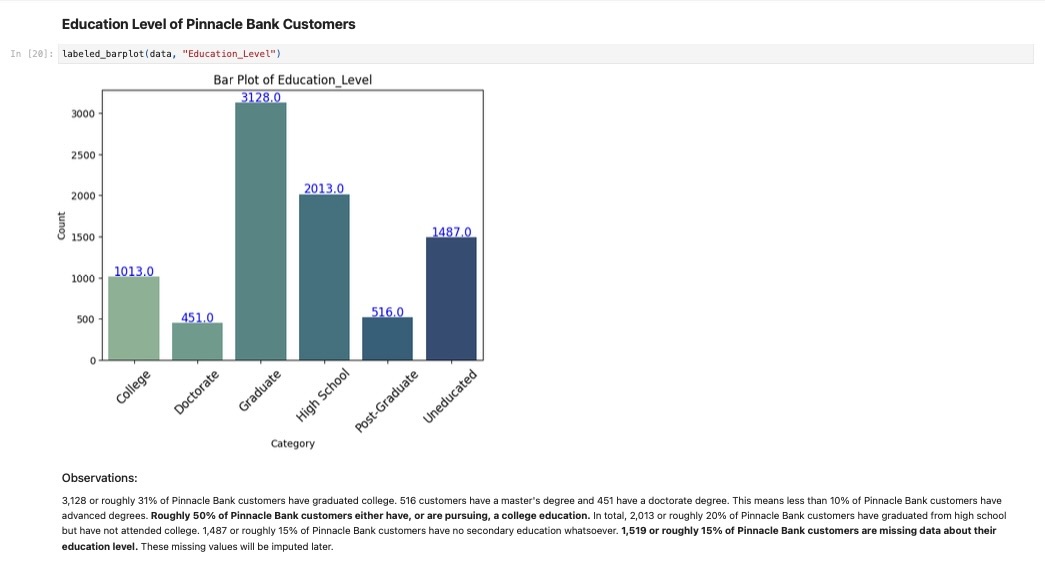

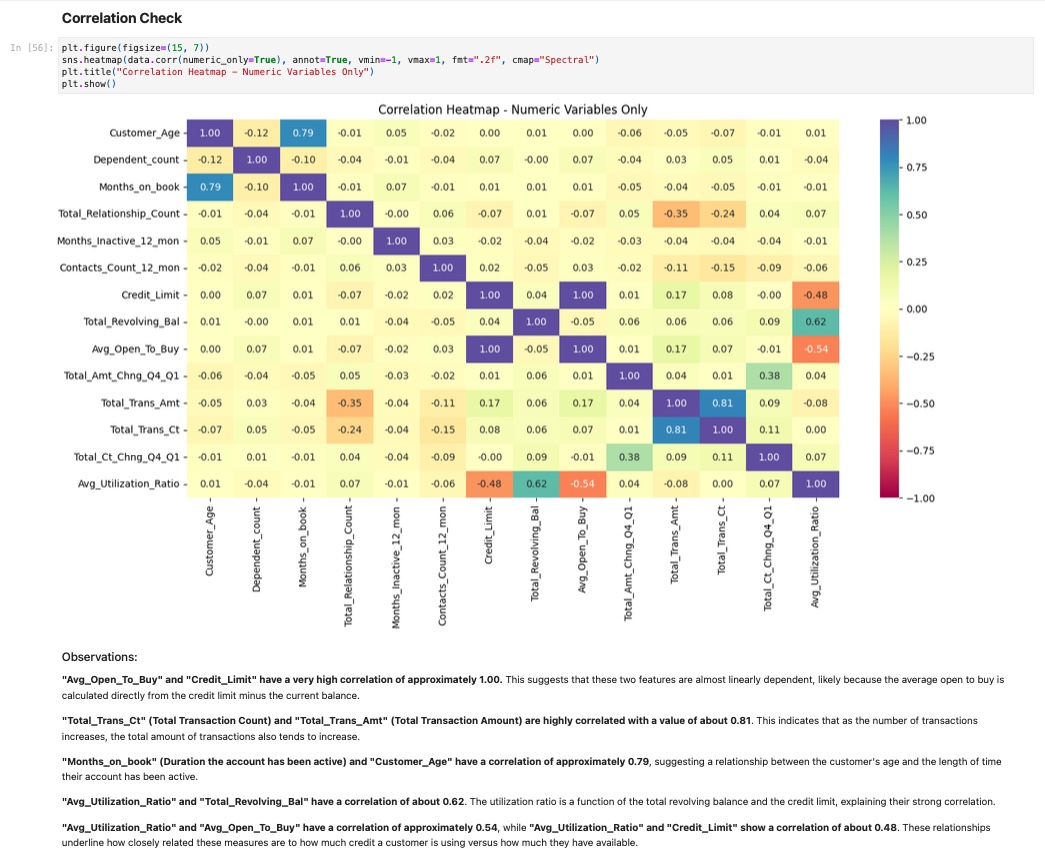

- Worked with a structured dataset of over 10,000 customer records containing demographic, transactional, and account activity variables.

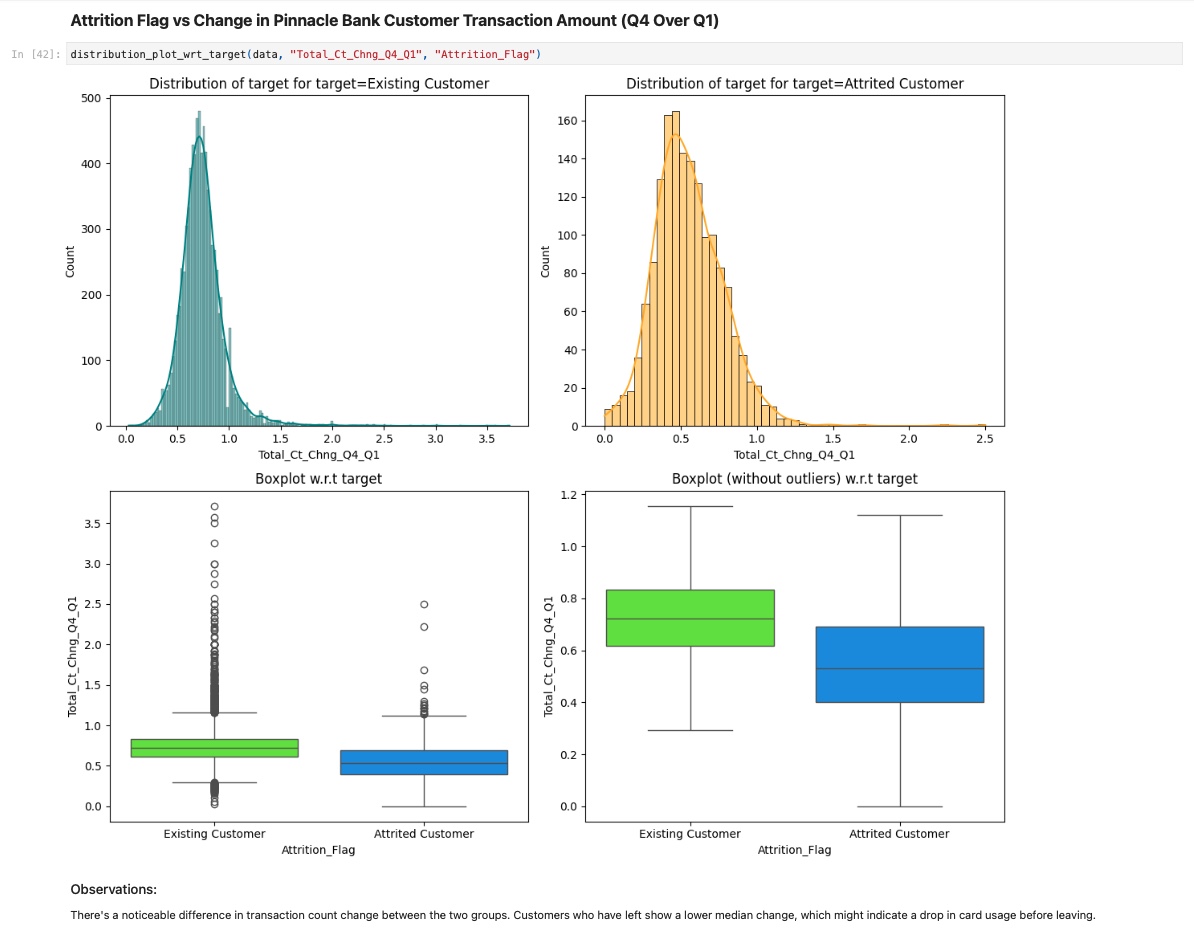

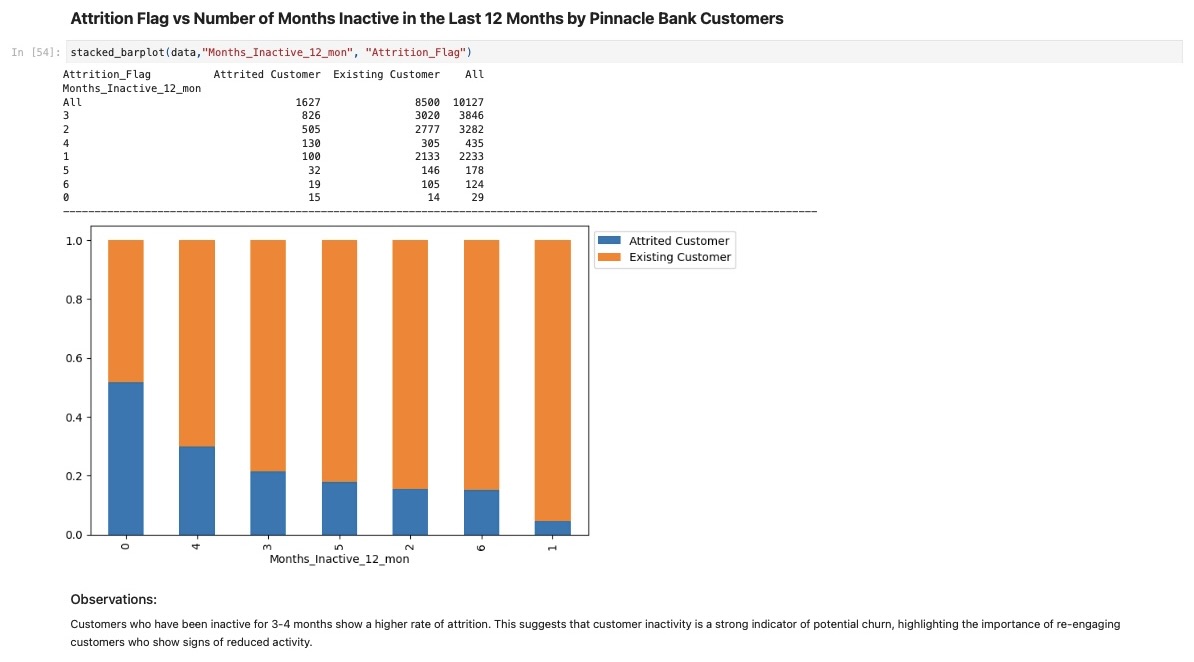

- Conducted EDA to identify key churn drivers and visualize relationships within the data.

- Handled the inherent class imbalance using resampling techniques to ensure the models could effectively learn from the minority (churn) class.

2. Model Design & Training:

- Trained and rigorously evaluated three powerful ensemble models: Random Forest, Gradient Boosting, and XGBoost.

- Focused the evaluation on finding the best balance between precision (minimizing false positives) and recall (capturing the highest proportion of true churners).

3. Model Evaluation:

- Compared models on precision, recall, and F1-score to determine the most robust solution.

- Key test set results for the "Churn" class:

- Random Forest: 82% Recall, 91% Precision

- Gradient Boosting: 84% Recall, 92% Precision

- XGBoost: 85% Recall, 92% Precision (Best Performer)

PERFORMANCE & VALIDATION

- Best Model: The XGBoost Classifier delivered the strongest results with 85% recall and 92% precision, demonstrating excellent generalization on unseen test data.

- The model successfully identifies the vast majority of customers who are likely to churn while maintaining a high level of accuracy in its predictions.

- This confirms that prioritizing a high-recall model allows the bank to minimize the risk of missing at-risk customers, which is crucial for effective retention.

IMPACT & BUSINESS RELEVANCE

- Retention ROI: The model enables Pinnacle Bank to proactively intervene, reducing customer attrition and protecting long-term revenue.

- Operational Efficiency: Improves the targeting of retention campaigns, focusing resources on customers most likely to leave.

- Scalability: The methodology is generalizable to other financial institutions or subscription-based businesses facing similar churn challenges.