EXECUTIVE SUMMARY

Developed a predictive model to identify bank customers most likely to accept a personal loan offer. By targeting the right customers, Citizens Bank can optimize marketing spend, improve conversion rates, and reduce wasted outreach.

THE CHALLENGE

- Citizens Bank wanted to improve the efficiency of personal loan marketing campaigns.

- Traditional blanket marketing was costly and resulted in low conversion rates.

- The goal was to predict which customers were most likely to accept a personal loan offer so that future campaigns could be more targeted and precise.

MY APPROACH

1. Data Preparation & Exploration:

- Cleaned and preprocessed customer records from a dataset of 5,000 customers. This included addressing data entry errors and irrelevant features.

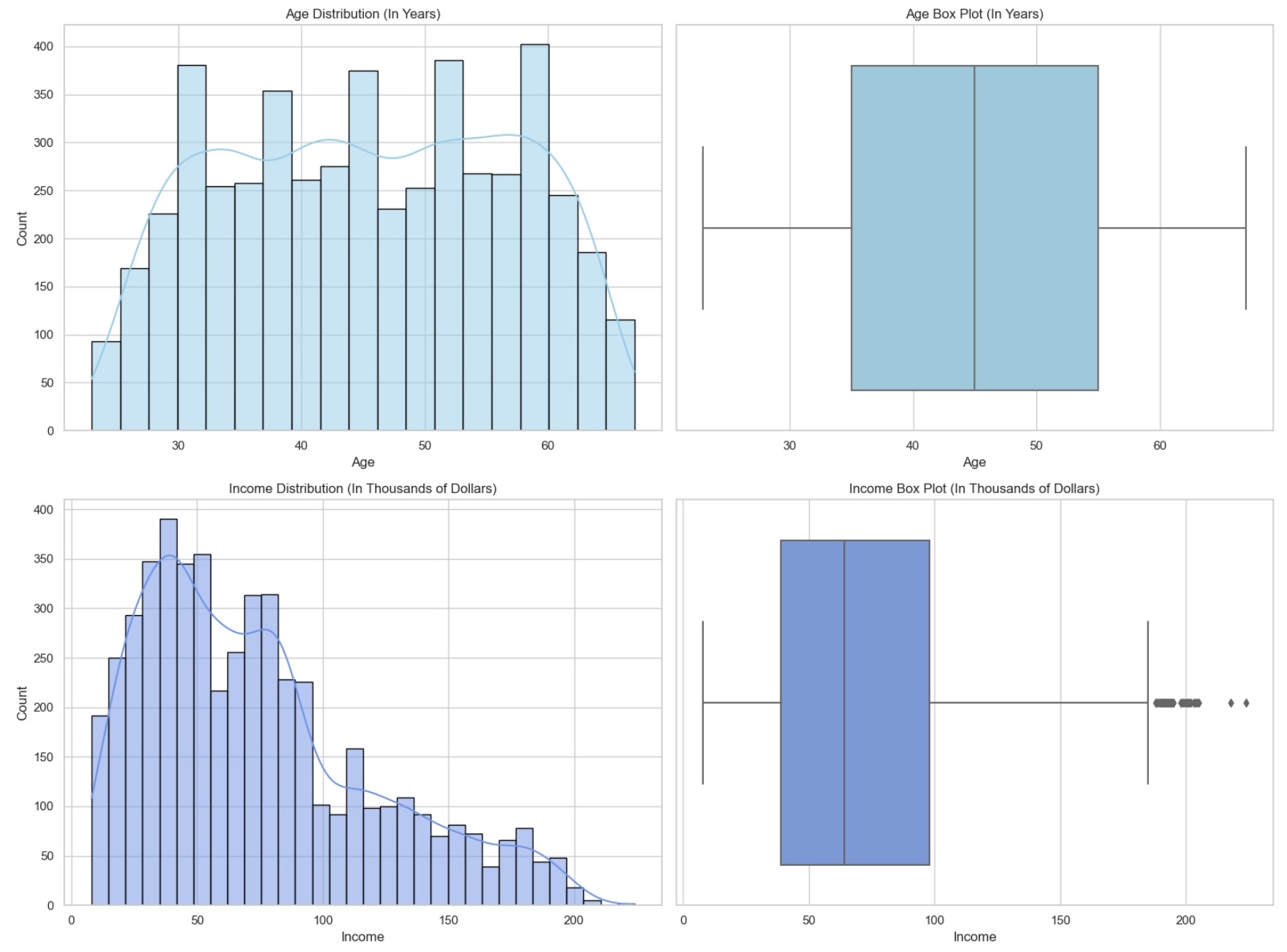

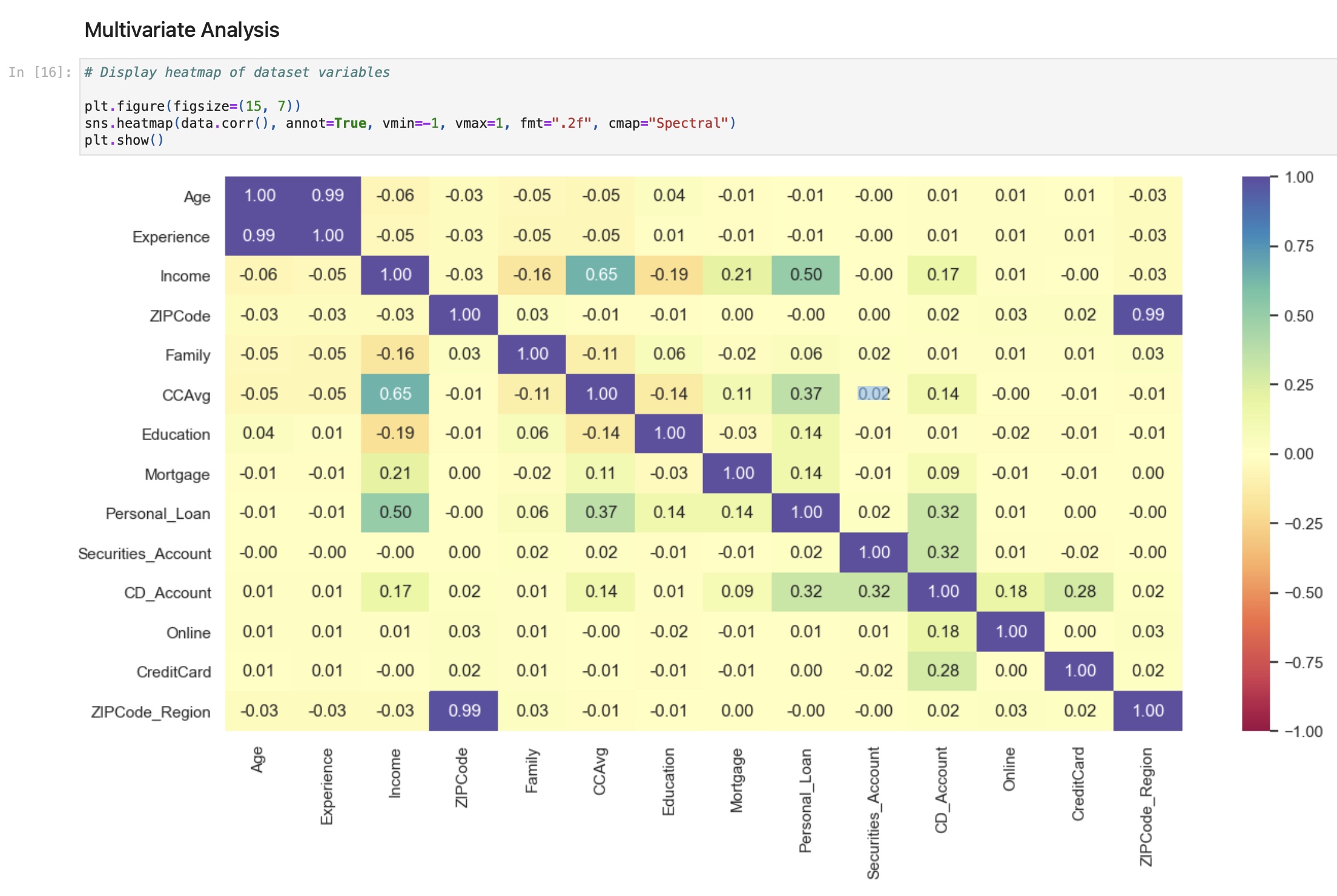

- Performed in-depth Exploratory Data Analysis (EDA) to explore distributions and understand the key drivers of loan acceptance.

2. Model Selection & Training:

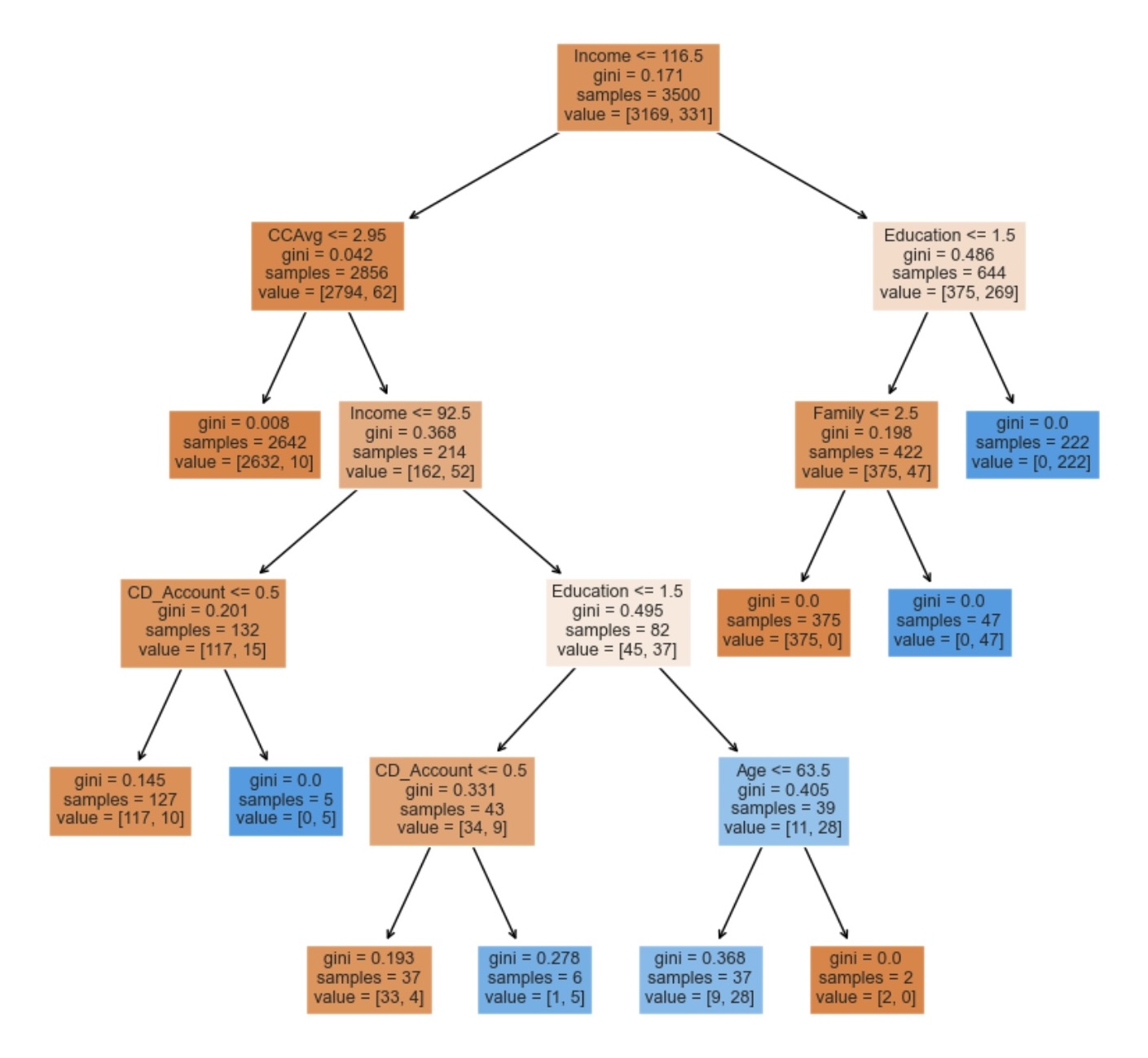

- Implemented a Decision Tree Classifier, a transparent and interpretable model well-suited for this classification task.

- Utilized a standard train-test split to prepare the data for training and evaluation.

- Pruned the Decision Tree to prevent overfitting, enhancing the model's ability to generalize to new, unseen customer data.

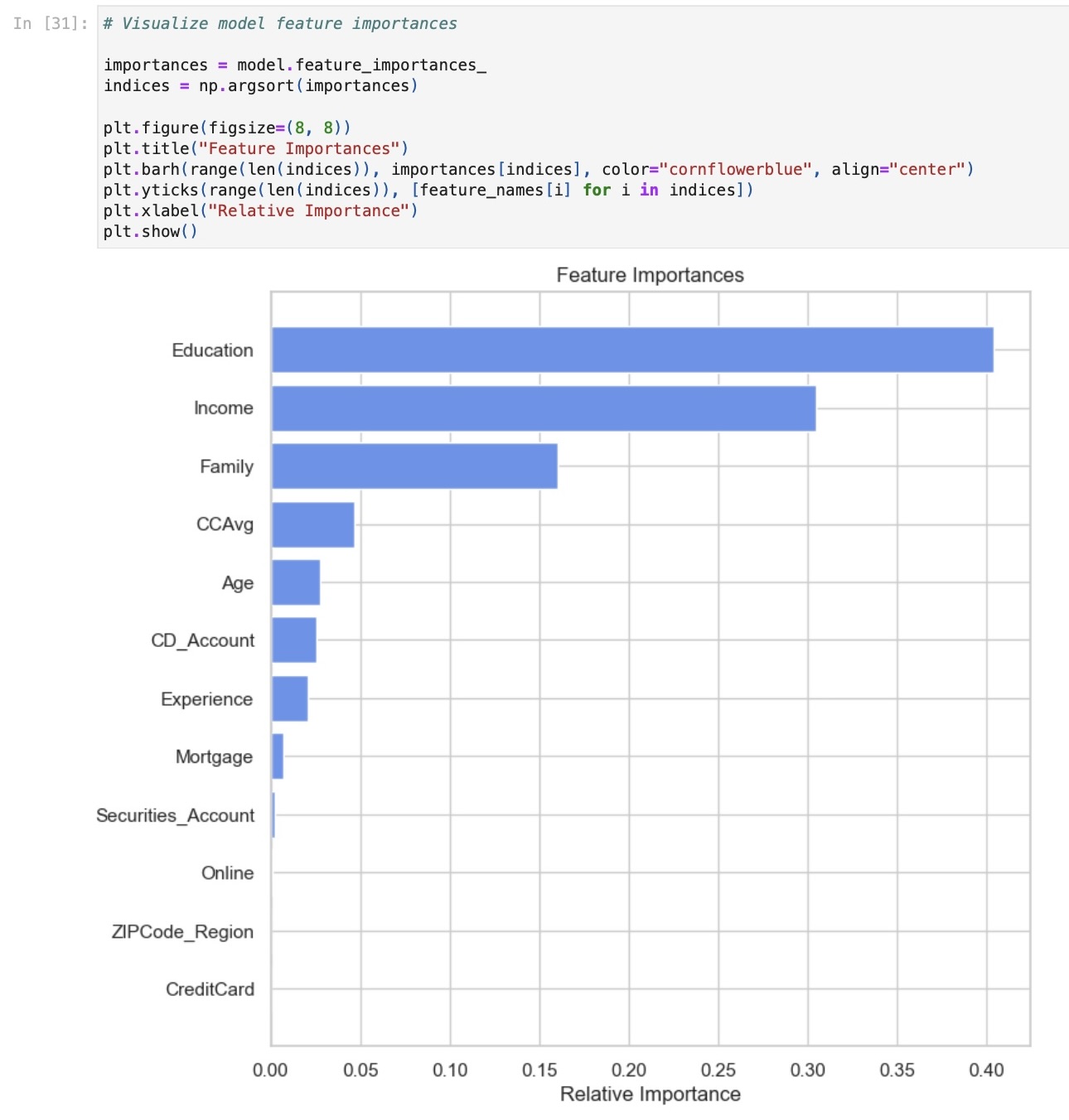

3. Evaluations & Insights:

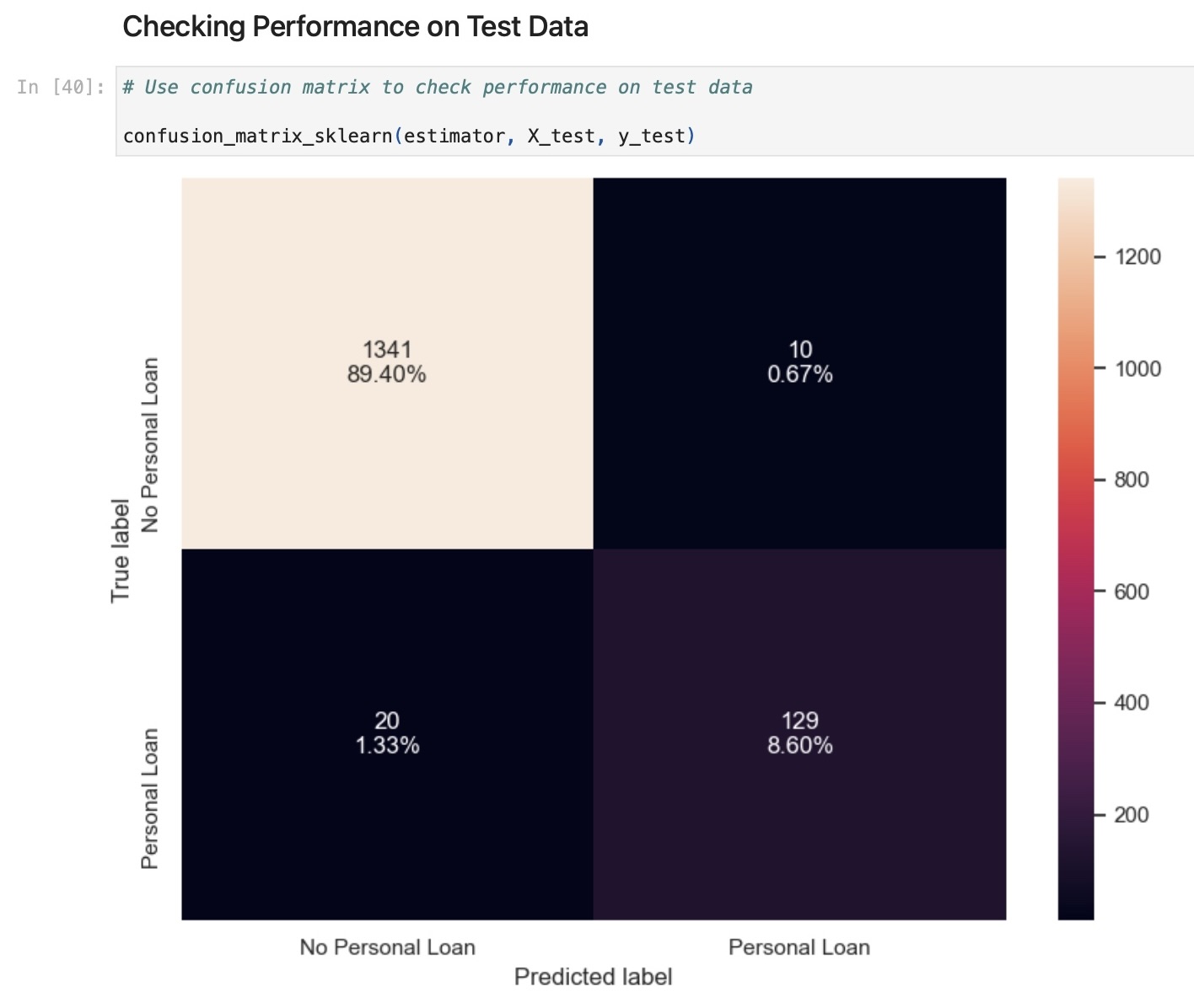

- Generated a confusion matrix and calculated key classification metrics—including accuracy, precision, and recall—to thoroughly assess model performance.

- Analyzed customer attributes to identify the characteristics most associated with a higher likelihood of accepting a loan, such as income, education level, and account ownership.

BUSINESS IMPACT

- Higher Conversion Rates: Targeting only high-likelihood customers can significantly boost marketing ROI.

- Lower Acquisition Costs: Fewer wasted outreach efforts.

- Scalability: Model can be retrained with updated data to adapt to changing market conditions.

NEXT STEPS

- Integrate into the bank’s CRM for real-time targeting.

- Expand features with transaction-level data for even greater predictive power.

- Conduct A/B testing to quantify uplift from targeted campaigns.